foreign gift tax return

Tax Exempt Bonds. If you are given money from a non-US citizen as a gift however you do need to declare it on Form 3520 if it is over 100000 in value.

Edible Gift Ideas For Tax Preparer Accounting Clients Totally Chocolate

The IRS will provide a copy of a gift tax return or the gift tax return transcript when Form 4506 or Form 4506-T is properly completed and submitted with substantiation and.

. Read customer reviews find best sellers. Below is the table for computing the gift tax. Further you must report foreign gifts from foreign corporations or foreign partnerships of more than 16649 as of tax year 2020 on Form 3520.

United States Gift and Generation-Skipping Transfer Tax Return. Nonresidents are subject to. Ad Browse discover thousands of brands.

Person receives a purported gift or bequest from a foreign corporation the purported gift or bequest generally must be included in the US. IRS Form 3520 is required if you receive more than 100000 from a nonresident alien or a foreign estate. However if after reading the instructions below.

Person or a foreign person or if the giftproperty is in the US. The gift tax is a tax on the transfer of property by one individual to another while receiving nothing or less than full value in return. Reg 252501-1 a nonresident alien donor is subject to gift tax on transfers of real and tangible property situated in the United States.

If you are a US. If the value of those gifts to any one person exceeds 15000 you need to file. Austria Denmark France Germany Japan and the United Kingdom.

You will not have to pay tax on this. Person is required to report the receipt of gifts from a nonresident or foreign estate only if the total amount of gifts from that nonresident or foreign estate is more than. Instructions for Form 1040 Form W-9.

In addition gifts from foreign corporations or partnerships are subject. About Form 3520-A Annual. For instance if US.

Citizens and residents are subject to a maximum rate of 40 with exemption of 5 million indexed for inflation. If you dont file Form 3520 within 90 days after the IRS notifies you of non-compliance youll face an initial penalty of 10000 for every additional 30. If an automatic 2-month extension applies for the US.

The value of the gift or bequest received from a nonresident alien or a foreign estatewhich includes gifts or bequests received from foreign persons related to the. A married couple may not file a joint gift tax return. This value is adjusted.

Form 3520 is used to report the existence of a gift trust or inheritance received from foreign persons. Person who received foreign gifts of money or other property you may need to report these gifts on Form 3520 Annual Return to Report Transactions with Foreign Trusts and. Individual Tax Return Form 1040 Instructions.

Foreign Gift Reporting Penalties. It doesnt matter if the gift is to a US. Persons may not be aware of their.

Check the box if you are married and filing a current year joint income tax return and you are filing a joint Form 3520 with your spouse.

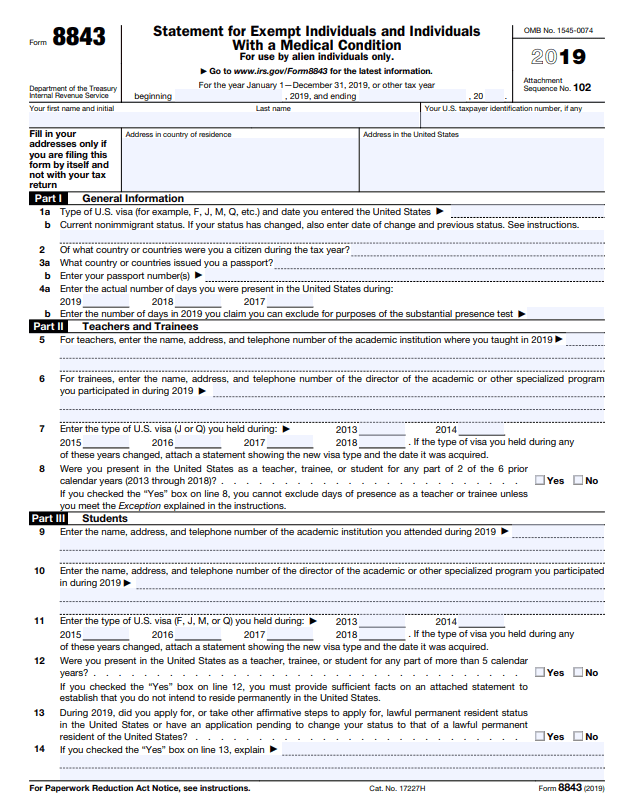

Us Tax For Nonresidents Explained What You Need To Know

Charitable Deduction Rules For Trusts Estates And Lifetime Transfers

2021 2022 Gift Tax Rate What It Is And How It Works Bankrate

Estate And Gift Taxes 2020 2021 Here S What You Need To Know Wsj

Gifting To Us Persons A Guide For Foreign Nationals And Us Donees Bny Mellon Wealth Management

Irs Expands Crypto Question On Tax Forms 1040 Cryptopolitan

Gifting Money To Family Members Everything You Need To Know

Irs Expands Crypto Question On Draft Version Of 1040 Financial Planning

/cdn.vox-cdn.com/uploads/chorus_image/image/62766854/897291366.jpg.0.jpg)

Government Shutdown 2019 How Tax Returns And Refunds Will Work Vox

To Win At The Tax Game Know The Rules The New York Times

Sharing The Wealth How Lifetime Gift Tax Exemption Works Charles Schwab

Gifts From Foreign Persons New Irs Requirements 2022

How To Fill Out A Fafsa Without A Tax Return H R Block

Gifting To Us Persons A Guide For Foreign Nationals And Us Donees Bny Mellon Wealth Management

Form 3520 Annual Return To Report Transactions With Foreign Trusts And Receipt Of Certain Foreign Gifts

Exploring The Estate Tax Part 1 Journal Of Accountancy

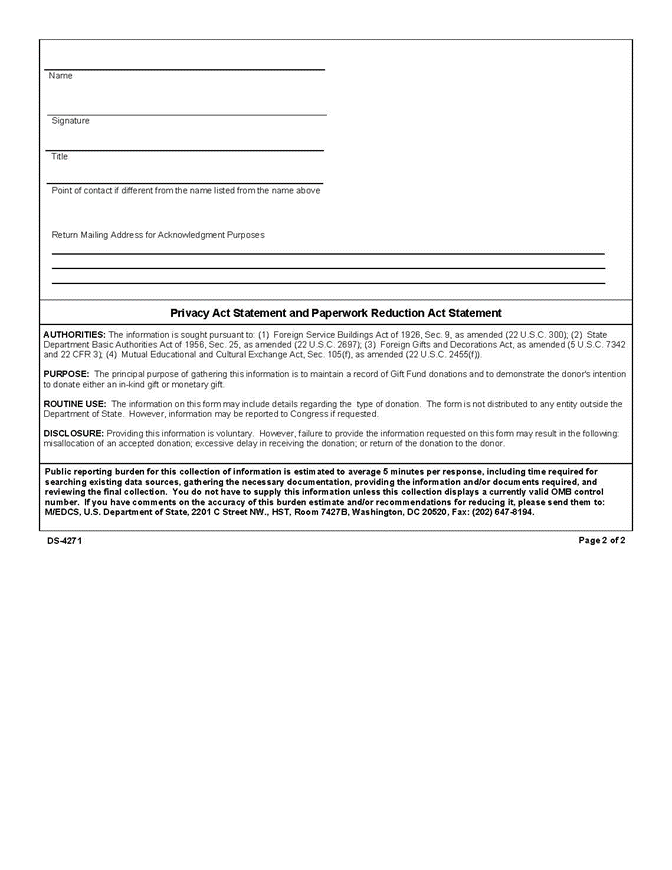

2 Fam 960 Solicitation And Or Acceptance Of Gifts By The Department Of State